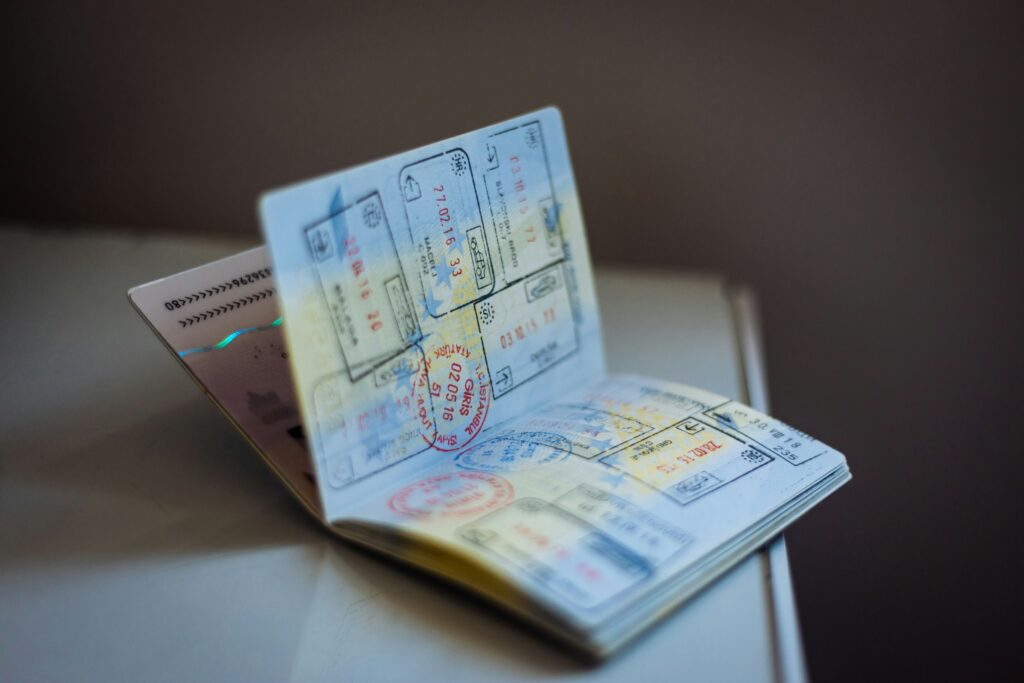

5 Tips To Increase Your Chances Of A Successful Visa Application From A Top Immigration Lawyer

One of the questions immigration lawyers get asked more than they have hot coffee is “what are the chances of my visa application being successful?” Now solicitors do not have a crystal ball, however they do have a lot of experience and know their stuff when it comes to visa applications. Waterstone Legal is one […]

What Do You Do If An Employee’s Visa Is Refused?

Hiring talent from overseas has become an important way for UK businesses to diversify, grow and develop their teams. At Waterstone Legal guiding employers through the recruitment process is a field we thrive in. This makes us one of the best immigration law firms in London. Having a lawyer on board from the start of […]

For Love Or Visa? How To Get A Spouse A Visa In The UK

When it comes to moving around the world, there are many motivations – though none are as great as love. If you are living in the UK and would like your partner to join you, a spouse visa application needs to be made. There are certain requirements, fee’s and a set process that needs to […]

Key Immigration Updates for Business Owners in 2025

Now we have arrived in January, it’s time to get back to business. If you are looking to employ workers from overseas this year, as an employer you may be responsible for assisting with visa sponsorship and more. To stay one step ahead, this article covers the key immigration updates that could affect your business […]